Office Hours: Monday – Friday 8:00 am to 4:30 pm

Please call to confirm office availability prior to your visit.

Fax: 847-546-8884

Angela Wold, CIAO – awold@granttwpassessor.com

Deborah Boisen – dboisen@granttwpassessor.com

Kevin Schmidt – kschmidt@granttwpassessor.com

Shawn Oakley, CIAO – soakley@granttwpassessor.com

ASSESSOR’S NEWS UPDATE

Grant Township Assessor Office Open House 5 20 2024 – Monday, May 20, 2024 5:00 – 7:00 pm

We welcome all Grant Township property owners to call or visit our office. We will be happy to answer any questions or concerns you may have regarding the process of determing your assessment and to assist you in filing your exemptions. Please click below for updates:

- February Newsletter 2024

- December Update 2023

- Property Tax Extension Limitation Law (PTELL) 9/18/23 Article

- August Update 2023

- June Update 2023

- February Update 2023

- July Update 2022

PROPERTY SEARCH – IMSLAKE.ORG

SMART E-FILING PORTAL

EXEMPTIONS

HOW TO APPEAL YOUR ASSESSED VALUE

PROPERTY TAXES

GIS MAP GALLERY

Responsibilities

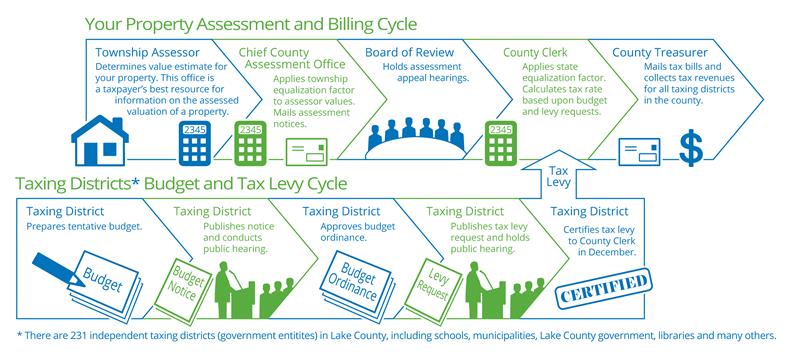

The Grant Township Assessor is your liaison to the Chief County Assessment Office. The Township Assessor is an elected position (4-year term) The assessor must be certified by the State and meet continuing education requirements.

The job of the assessor is to value all taxable parcels of property within the township in a uniform manner, so all properties are valued at the same approximate assessment level. This creates a fair share spread of the real estate tax burden.

- Value all non-exempt, residential & commercial properties per the 2024 Instructions for Assessing Property in Lake County

- Visit, photograph and measure all properties in the township to continually update each Property Record Card (PRC) on www.imslake.org

- Record all permits issued from the Villages of Fox Lake, Round Lake, Volo, Lakemoor and Lake County for unincorporated areas. Follow up, document any change in real property and adjust valuation accordingly.

- Initiate Home-Improvement Exemptions (monitor qualifying properties for maximum $75,000 full market value ($25,000 assessed value) 4-year exemption)

- Record & analyze all real estate transfer declarations

- Review & correct the Illinois Department of Revenue Sales Ratio Studies

- Beginning in 2019, all exemptions in Lake County must be filed online. However, we will still help you file Homestead Exemptions here in our office. Seniors, Veterans & Disabled Persons renewal reminders are sent annually from the Chief County Assessment Office.

- Monitor Preferential Assessments

- Distribute literature concerning the assessment and tax bill process and answer Frequently Asked Questions (FAQ’s)

- Print copies of current or past tax bills. Also available here

- Assist in filing & verifying agricultural/farmland valuation per IDOR’s Publication 122

- Supply names and addresses for properties applying for municipal variances

- Represent Grant Township during assessment appeal hearings at both the Lake County Board of Review and State of Illinois Property Tax Appeal Board

- Provide information as requested for Assessment Appeals

- Coordinate appraisals as required for large scale Assessment Appeals

- Offer free notary public for Grant Township residents

Appeal Period

Q: How do I appeal my taxes ???

A: You cannot appeal your TAXES – you can only appeal your ASSESSMENT.

When you receive your tax bill, check the lower left hand section of your bill. Under Taxing Body, you will see the amount of your property tax paid to each taxing body and the change from the prior year is the increase or (decrease) in the amount payable to the taxing body listed. This is to show you where your money goes.

Typically we hear from many homeowners during the month of May who are unhappy with their property tax bill. My suggestion has been and still is to contact the taxing body with comments/questions so that they are aware of your concerns when they are working on their levy for the next year. By law, in Illinois, all tax levy certifications are due to the County Clerk by the last Tuesday in December.

We do not determine or control the amount of property taxes you must pay.

Property taxes exist because of local government spending. Taxing bodies schools, villages, townships, county, police and fire districts, libraries, park districts, etc. depend on property tax revenues to provided local services. Each year they submit a request for property tax funds, known as the “levy”. The combined “levies” create the tax burden, while assessments simply divide up that tax burden in an equitable way.

Levy divided by Assessed Value equals Tax Rate

The levy is the amount of tax dollars that your taxing bodies request. The assessed value is the total of the assessments in the taxing district. The Tax Rate is nothing more than the calculation: the result of dividing the LEVY by the ASSESSED VALUE. Taxes go up because Levies go up. Assessed values and tax rates are just the tools used to divide up the total tax burden created by the combined levies of our local taxing bodies.

Here is how it works – Our taxing body requests $100,000 (the Levy), and total assessments are 2,000,000. The tax rate now is .0500 ($100,000 divided by 2,000,000). If your assessment is 10,000 then your taxes will be 10,000 x .05 or $500.

Q: If property values go down, won’t my taxes go down?

A: Let’s see…Our Taxing body is still requesting $100,000 (the Levy) but total assessments are 1,800,000, down 10%. The tax rate now becomes .0556 ($100,000 divided by 1,800,000). If your assessment is 9,000 (down 10%), then your taxes will be 9,000 x .0556, still $500. Taxes didn’t change – even though assessments went down – because the LEVY didn’t change. The Levy drives the tax bill.

Q: What if the levy increases but my assessment goes down?

A: The Levy is $110,000, 10% more, and assessments are 1,800,000, down 10%. The tax rate is .0611 ($110,000 divided by 1,800,000). If your assessment is 9,000 (down 10%), then your tax bill will be 9,000 x .0611 =$550. Up 10% like the levy, not down 10% like your assessment. The Levy drives the tax bill.

Generally, taxes do not go up because of increasing assessments and they will not go down with declining assessments. On an individual basis, if one assessment goes down substantially more than others, that one property owner may see more relief in their taxes, the tax burden has been redistributed. If one assessment doesn’t change when most go down, that tax bill may increase – the tax burden has been redistributed. But, if assessments all decrease by a similar amount, there will be absolutely no change in your tax bill unless the levy changes.

Levies go up because local government spending goes up and taxes go up because Levies go up – even when assessments go down. Assessments and tax rates do not change the tax burden, they only distribute the tax burden that is created by the levies.

Taxes are the result of spending, not assessments, and if spending doesn’t go down, taxes won’t go down either. Increased spending by taxing bodies is what increase taxes. The property tax system is far from perfect, but the good part is that the money paid locally stays local. We can see what we are paying for, and we can decide whether we are getting our monies worth. And, if we don’t think we are, we can talk to our local elected officials about it. The board meetings of all taxing bodies are public meetings and open to public scrutiny. The only way to control taxes is to control local government spending.